When your credit isn’t in the best shape, the prospect of getting a vehicle loan could seem daunting. A more practical alternative to conventional loans, In house car financing allows more people to purchase cars.

Explain What “In House Car Financing” Means and How It Operates

A financing arrangement known as “in house car financing” involves the dealership taking on the roles of both the lender and the seller of the vehicle. The dealership takes care of all the financing instead of you having to go to a bank or credit union, making it easier for you to buy a car. Instead of paying a third-party lender each month, you pay the dealership directly, so they have the car until you pay off the loan.

The Steps Required

Obtaining in-house financing usually entails a few simple stages:

- Pick Your Vehicle: Take your pick from the new and used cars available at the showroom.

- Fill out an application for financing with the help of the dealership’s financial staff.

- The dealer will look at your financial situation, including your job status, income, and capacity to pay.

- Get the details of your loan, including the interest rate, monthly payment, and length, once it’s accepted.

- Take ownership of your automobile and sign the contract to finalize the deal.

The approval process for dealer financing through in-house programs is typically completed the same day, as opposed to the days or weeks it takes for traditional financing through banks.

Comparison of Bank Loans versus In-House Financing: Pros and Cons

Major Benefits

Especially for purchasers dealing with credit issues, in-house financing provides numerous attractive advantages:

- With in-house financing, dealerships care more about your present income and job security than they do about your credit history, which means an easier approval process. This expands the pool of potential applicants to include those with less extensive or weak credit histories.

- Convenience and Speed: From choosing a vehicle to getting approved for finance, it’s all done in one place. Avoiding the hassle of corresponding with numerous lenders is usually possible because the whole process can be completed in a single visit.

- More Forgiving Requirements: Unlike with conventional bank loans, the requirements for in house auto loans are often more relaxed. Instead of making rigid algorithmic conclusions, dealerships can make exceptions depending on certain conditions.

- The dealership takes care of everything in-house, so you won’t have to deal with any other parties or wait for clearance from a lender.

Possible Downsides

On the other hand, there are a few constraints and hazards associated with financing an automobile internally:

- Subprime car financing and In house auto loans from dealerships typically have higher interest rates than loans from regular banks. Depending on your credit score, rates can be as high as 20%.

- Constrained Vehicle Options: Unlike with pre-approved financing, which is valid at numerous dealerships, you are limited to choosing from the dealership’s inventory.

- The risk of repossession increases in the event that you are late with a payment because the dealership maintains legal title to the car until the loan is fully repaid.

- More Money Outlay: Over the course of the loan, you can end up spending a lot more money due to factors including increased interest rates and possibly raised car costs.

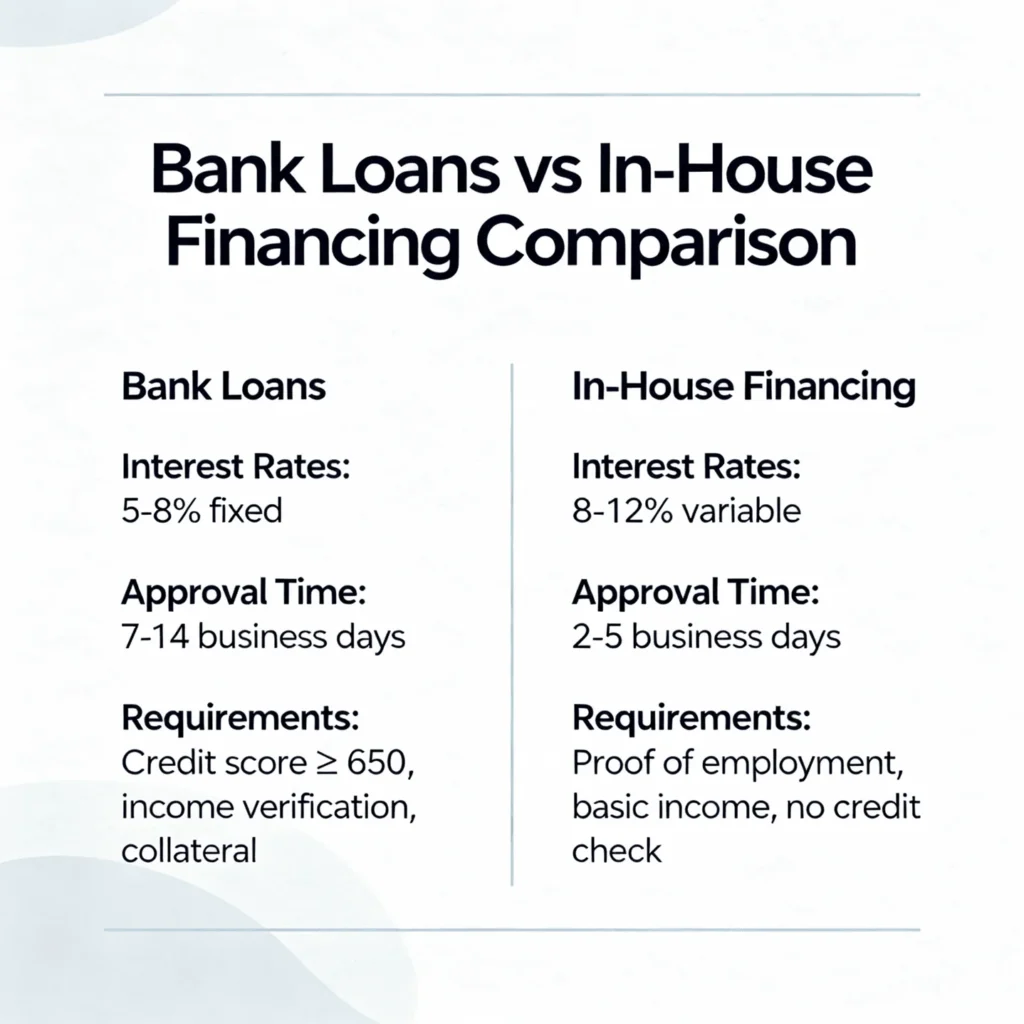

Evaluation in Light of Conventional Bank Loans

Highlight Bank Loans and In-House Financing

- Time to Approval: 1–7 days

- Credit Requirements: Rigidity Reduction

- Interest Rates: Increased (12–20%+) | Lower (4–8% for good credit)

- Deposit: Usually up to 20% | Usually up for discussion

- Choice of Vehicles: Restricted to inventory at dealer | Any eligible vehicle

Does My Credit Matter Enough to Get Subprime Car Financing or an In-House Auto Loan?

Customers with credit problems or other issues that could prevent them from getting a loan through a regular bank might be good candidates for In house car financing. You can better assess the appropriateness of this financing option by familiarizing yourself with the qualifying conditions.

Variability in Credit Scores

Credit ratings as low as 650 are often accepted by in-house finance dealerships, in contrast to more conventional lenders. Among these are:

- Borrowers with subprime credit (501–600).

- Credit ratings between 300 and 500 are considered deep subprime.

- Customers who are new to the country or who have just immigrated may not have a credit history.

- A significant credit event in the past, such as bankruptcy.

Job Requirements and Income

The emphasis in Dealer financing bad credit programs is on your present financial stability, not your credit history. A majority of car lots need:

- Following taxes, a minimum monthly income of $1,200 to $2,000 is usually required.

- Work History Verification: Typically, six months of continuous employment is required; however, certain employers may accept as little as two or three months.

- Income Stability: A steady stream of money coming in from a job, being self-employed, disability benefits, or some other legitimate source.

Need for Documentation

Typical requirements for in house auto loans include:

- Photo identification issued by the government, preferably a driver’s license.

- Documentation proving funding (such as pay stubs, bank records, or tax returns).

- Proof of residence, such as a utility bill or a lease, is required.

- Personal or professional references.

- A down payment, the exact amount of which can differ depending on the dealership and the vehicle being purchased.

Unique Situations

Buy here pay here lots often work around customers’ specific needs:

- People whose income is dependent on their own productivity.

- Workers whose incomes are subject to seasonal fluctuations.

- Those receiving a fixed income, such as those receiving Social Security or disability payments.

- Any changes in employment or professional paths in the past month or two.

- Alternative sources of income.

The most important thing is to show that you can pay your bills on time every month, no matter what your credit score is.

What You Must Know About Buy Here Pay Here Financing

One form of in-house financing that has grown in popularity among dealers catering to customers with credit issues is buy here pay here. You may make a more educated decision regarding the purchase of a vehicle if you are familiar with how these programs function.

The Process of Buy Now, Pay Later

Without the need for intermediaries, BHPH dealerships handle both vehicle sales and finance in-house. What sets them apart is this:

- Direct Lending: Instead of going via traditional lending institutions like banks or credit unions, the dealership uses their own money to issue credit.

- With in-house collections, you pay the car lot straight out of your paycheck, usually every week or two instead of once a month.

- Flexible Approval: Income and ability to pay are the main factors used to determine eligibility, not credit ratings.

Choices for Payment Structure

Many dealerships that provide buy here pay here services also have flexible payment plans that can be adjusted to fit your income cycle:

- 52 payments totaling 52 weeks: this is the consequence of dividing your monthly payment by 4.33.

- Make payments every two weeks, for a total of 26 payments per year.

- Regular Payment Schedule: The standard schedule for making payments is once a month.

By lowering the overall amount of interest paid over the life of the loan, these expedited payment plans can really end up saving you money.

Standard Conditions and Terms

Typical components of buy-now-pay-later plans are:

- Interest rates that are higher, ranging from fifteen to twenty-five percent APR.

- Loan periods that are 24 to 48 months shorter.

- 10–20% of the car’s worth is the minimum down payment that’s needed.

- Global positioning systems (GPS) for use in locating lost vehicles.

- Timely responses to late payments and regular monitoring of payments overall.

Why BHPH Programs Are Beneficial

There are a number of benefits to buy here pay here for the proper borrower:

- No minimum credit score needed and no credit checks whatsoever.

- Authorization and car delivery on the spot.

- A shot at repairing credit (provided the dealer reports to the credit agencies).

- Payment plans that are adaptable to your income cycle.

Vital Factors to Think About

Although BHPH finance makes it possible, there are a few things to keep in mind:

- Elevated interest rates lead to a higher total cost.

- You can buy vehicles with a limited warranty or on an “as-is” basis.

- If payments are not made on time, repossession could happen quickly.

- Not all dealers give credit bureaus a good report on their customers’ payment histories.

Advice on How to Increase Your Prospects of Getting Dealer Financing Despite a Poor Credit Score

Improving your application’s strength will help you obtain better terms and increase your acceptance chances, even with flexible In house car financing choices.

Gather All Necessary Documents

Maintaining order in paperwork not only shows accountability, but it also expedites the approval process:

- Get your most current bank statements, tax returns, and pay stubs for the income verification process.

- Documentation of job stability and longevity should be prepared and kept in the employment records.

- Utility invoices or lease agreements that demonstrate steady housing can be used as proof of residence.

- References: Get the names and contact details of individual references, both professional and personal, prepared.

Establish a Rainy-Day Fund

You can greatly enhance your loan terms and approval odds with a greater down payment:

- With a smaller loan amount, the dealership takes on less risk, which is good for the lender.

- Reduced financing costs mean cheaper monthly payments, which is a huge benefit.

- Displays Dedication: Proves that you’re serious about buying and keeping the car.

Consider utilizing your current vehicle as a portion of the down payment when exploring trade-in options.

What About a Co-Signer?

Your chances of acceptance will increase significantly if you have a qualified co-signer:

- Co-signer’s Strong Credit Can Help You Get a Loan Even If Your Own Credit Isn’t Perfect.

- You could be eligible for more favorable loan terms, including reduced interest rates, if you do this.

- Joint Liability: In the event that you are unable to make payments, the co-signer promises to do so.

Find a Reputable Dealership: Look into auto lots that work specifically with bad credit car financing.

Applying at the Right Time

Your chances of acceptance can be enhanced through strategic timing:

- At the end of the month or quarter, dealerships may be under extra pressure to close agreements in order to reach their sales goals.

- Don’t Apply More Than Once: A low credit score and signs of desperation are caused by an excessive number of credit inquiries.

- Application Completion: To prevent delays, please ensure that all forms are filled out precisely and completely.

Keep Your Spending in Check

To successfully complete the loan, it is helpful to understand your financial limitations:

- In addition to the monthly payment, you should add the prices of insurance, registration, and maintenance when calculating the total expenditures.

- Make a contingency plan: If your income suddenly drops, you still need to be able to pay your bills.

- Instead of breaking the bank on a flashy car, choose a dependable model that meets your needs.

The Dealership In-House Financing Process: What to Anticipate

You can better prepare for your dealership visit and avoid unpleasant surprises if you are familiar with the In house car financing process.

Preliminary Request and Evaluation

In most cases, the first step is to fill out an extensive application:

- Name, address, contact information, and details for verifying identification make up personal information.

- Job Information: Present position, contact info for the company, and duration of employment.

- Proof of Income: Most recent pay stubs, bank records, or similar documents.

- Existing debts, ongoing expenditures, and financial obligations make up financial obligations.

Evaluation of Resources

There are a number of criteria that the dealer financing team uses to assess your application:

- The debt-to-income ratio measures how much of your gross monthly income goes toward paying off debt each month.

- Payment History: Even if credit ratings can be adjusted, it’s crucial to consider how you’ve paid for things recently.

- Indicators of stability include length of employment, length of residency, and constancy of income.

- The amount you are able to put down as a down payment on a purchase.

Methods for Choosing a Vehicle

After getting pre-approved, you’ll have to stick to the terms of your loan:

- The dealership will only display automobiles that fall within your pre-approved loan amount, so be mindful of your budget.

- Take advantage of the opportunity to inspect the vehicle by driving it about and looking it over carefully.

- Pay attention to the “as-is” sale conditions and warranty coverage.

Complete Documentation and Final Approval

Last but not least, fill out the required paperwork:

- Read the loan agreement carefully and make note of the interest rate, repayment dates, and total amount of time you will have the loan.

- Insurance Needed: Get all-inclusive insurance before you take possession.

- Finish the registration process and familiarize yourself with the title-holding arrangements for your vehicle.

- Payment Setup: Talk to the dealership about how and when you’ll pay.

Need for a Deferred Payment

A down payment is usually required for In house car financing, though the amounts might vary:

- Ten to thirty percent of the car’s worth is the usual range.

- Terms that can be worked out: depending on your financial situation, certain dealerships may be willing to be flexible.

- Methods of Payment: Most vendors accept cash, certified check, or the value of the item being traded in.

Better interest rates and lower monthly payments are common outcomes of larger down payments, which impacts terms.

Anticipated Schedule

When compared to more conventional bank loans, in-house financing typically takes less time:

- You can get it done in a few hours at most dealerships, and the service is available on the same day.

- Delivery of Documentation: Initial application evaluation typically takes 30–60 minutes.

- Time required for test drives and final selection during vehicle inspection.

- Finalizing loan paperwork and car preparation: one to two hours.

Common Misconceptions About In House Car Loans and Financing at Dealerships

People may be hesitant to look into In house car financing due to a few misconceptions. The facts are as follows:

- First Myth: Unusually High Interest Rates Are Always Involved When Financing In-House

- Rates can still be competitive for subprime car financing, but they can range from 12% to 20% and depend on factors like the borrower’s income stability, the size of the down payment, and the value of the vehicle.

- Second Myth: BHP dealers exclusively sell “clunkers.”

- Fact: You can find inspected vehicles from well-known manufacturers like Ford and Toyota at many buy-here-pay-here lots. These vehicles come with service records and limited warranties.

- Third Myth: A Perfect Credit Score Is Necessary to Get a Car Loan.

- The fact is that in-house vehicle loans prioritize income and repayment capacity and so are accessible to those with credit ratings below 600, little to no credit history, or even a history of bankruptcy.

- Fourth Myth: Compared to bank loans, dealer financing is always more expensive.

- Dealer financing bad credit often offer customized financing alternatives, promotional rates, and manufacturer incentives, which can make them competitive with bank lending for customers with bad credit.

- Fifth Myth: Huge Initial Investments Are Required

- In reality, down payments are usually negotiable and might range from 10% to 30%. To help you get an in house car loan, some dealerships may take trade-ins or even offer zero-down choices.

- Sixth Myth: Using In-House Financing Will Not Stimulate Credit

- Truth: Your credit score will gradually rise if you pay for your loan on time while financing at a dealership because many dealers disclose this to the credit agencies.

- Seventh Myth: It’s Too Difficult

- Convenience: In house car financing can often lead to same-day approval, minimum paperwork, and a streamlined process—making it easier for you to own a car.

In Summary

Buyers who don’t meet the requirements for conventional bank loans or who just want the ease of doing everything in one place could benefit greatly from In house car financing. These financing options allow people with varying credit histories to acquire vehicles, but they usually have higher interest rates and need careful planning.

If you want to get a car loan from an in-house lender, it’s important to know what to expect, get all of your paperwork in order, and work with a trustworthy dealership that values its customers and treats them fairly. In dealer financing bad credit programs, the emphasis is on your present financial stability rather than your credit history, so you can have dependable transportation and maybe even improve your credit score in the process.

You can still own a car with in-house financing, even if you have bad credit, a short credit history, or just prefer to do everything at the dealership. If you want to be financially successful in the long run, you should take your time researching your alternatives, comparing conditions from different dealers, and making sure that any financing agreement fits comfortably within your budget.

If you have come this far maybe this will answer another query you might have